LBG Media – Looking For A Favourable Guidance For The Balance Of Its Trading Period

- Mark Watson-Mitchell

- Sep 18, 2024

- 3 min read

Tomorrow morning will see the largest publisher on Facebook, LBG Media (LON:LBG), declare its Interim Results for the six months to end-June – they are expected to be showing good figures and a positive statement.

The Business

LBG Media is a global digital entertainment business with a focus on young adults and a leading disrupter in the digital media and social publishing sectors.

It produces and distributes digital content across a range of mediums including video, editorial, image, audio, and experience (virtual and augmented reality).

Since its inception in 2012, the group has curated a diverse collection of specialist brands using social media platforms (primarily Facebook, Instagram, Snapchat, X, YouTube and TikTok) and has built multiple websites to reach new audiences and drive engagement.

Each brand is dedicated to a distinct popular interest point (e.g. sport, gaming etc.), which is designed to achieve broader engagement, increase relevance and ultimately build a loyal community of followers.

The group operates two core routes to market:

· Direct revenue, which is principally generated from the provision of content marketing services to corporates, brand owners, marketing agencies and other entities such as government bodies and where the relationship with the client is held directly by LBG Media; and

· Indirect revenue, which is generated via a third-party, such as a social media platform or via a programmatic advertising exchange / online marketplace, which holds the relationship with the brand owner or agency.

Recent Trading Update

On Wednesday 24th July, the group announced that it expected first-half revenues to be up 55% to £42.3m (£27.2m).

The group’s direct revenues were up 92% at £22.0m (£11.5m), while its indirect revenues were just 28% better at £19.7m (£15.3m).

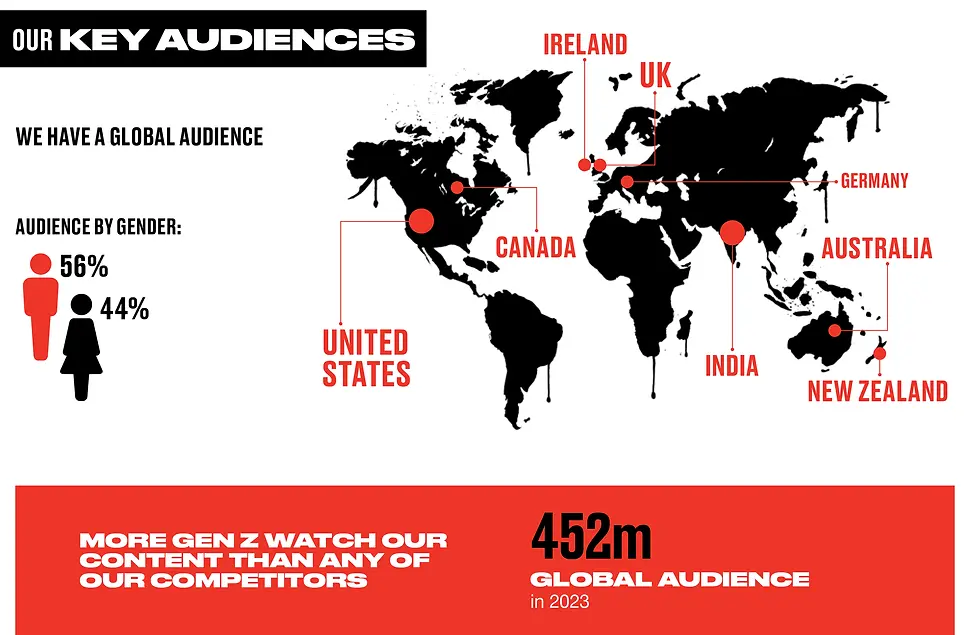

Overall, the group’s global audience expanded to a significant 493m, which compared to 452m last December and just 410m in June 2023.

CEO Solly Solomou stated that:

"It has been a strong start to the year as the business continues to make good progress along the line of sight to £200m of revenue.

Performance in Direct and Web highlight the strength of our diverse revenue model and the operational changes in ANZ are delivering planned benefits, with further expansion of our partnership within the APAC region.

We have continued the integration of our US commercial teams to leverage early customer wins by presenting a 'one stop shop' for brands wanting to reach a diverse young adult audience.

I am extremely excited by the opportunities ahead as our diverse revenue model and strong momentum position us well for continued success."

Change Of Year-End

The group has announced that it plans to change its financial year-end from 31st December to 30th September.

That move will mean that the seasonal peak in advertising spend now in the Q4 period, will instead fall into the first half of the financial year, enabling a better planning ability for its management.

Analyst View

Rachel Birkett at Zeus Capital has estimates out for the year to end-December, showing total revenues of £89.7m (£67.5m), with adjusted pre-tax profits of £19.6m (£14.0m), generating 6.7p (4.9p) of earnings per share.

Prior to the recent news that the group is changing its year-end, the analyst was looking for 2025 to produce £98.7m in sales, £22.2m in profits, with 7.7p of earnings per share.

Zeus considers that the shares are trading on an undemanding rating for such a profitable and highly cash-generative business that is well-positioned in fast-growing digital media niches.

In My View

With its shares, at 136.5p, having more than doubled since mid-April, they are currently trading near their year’s High, which values the group at £290m.

This is a total growth situation stock, backed by some £23m of cash in the bank.

It would be good if tomorrow’s results will issue a favourable updating of guidance, which could well help to push the shares even higher still.

Comments